pa educational improvement tax credit individuals

Educational Improvement Tax Credit EITC Opportunity Scholarship Tax Credit Program OSTC and Educational Improvement Organization EIO Programs. Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit.

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

The State of PA created the.

. A program that benefits. This translates to a tax credit of 3150 which will be usedrefundable if. Educational Improvement Tax Credit EITC.

Based On Circumstances You May Already Qualify For Tax Relief. Individual Donor Requirements. Pa Educational Improvement Tax Credit IndividualsQuestion 1 question 2 185 of federal poverty level Through the educational improvement tax credit program.

Donate at least 3500 in one check to the SPE. Find a Dedicated Financial Advisor Now. The PA S corporations and partnerships report restricted tax credits on PA-20SPA-65 Schedule OC.

Businesses individuals and schools. How Pennsylvanias educational tax credits are used who benefits and more. The total amount of tax.

Pennsylvanias Educational Improvement Tax Credit EITC program is a way for businesses to enrich educational opportunities for students and earn tax credits by donating to. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Schneider Downs is the 13th largest accounting firm in the Mid-Atlantic region and serves individuals and companies in Pennsylvania PA.

List of Educational Improvement Organizations Effective 712015 6302016 EITC. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

The Educational Improvement Tax Credit EITC and Opportunity Scholarship Tax Credit OSTC programs provide tax credits to eligible individuals contributing to the Scholastic Opportunity. In either case the maximum tax credit is 750000 per company. Elizabeth Hardison - June 14 2019 721 am.

However sometimes they are awarded to individual or fiduciary taxpayers. Do Your Investments Align with Your Goals. Credits are awarded to companies on a first-come first-served basis until the cap is reached.

Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for. Pennsylvania makes millions of dollars available each year through the Educational Improvement Tax Credit Program EITC to. Ad Fill Sign Email PA REV-1123 More Fillable Forms Register and Subscribe Now.

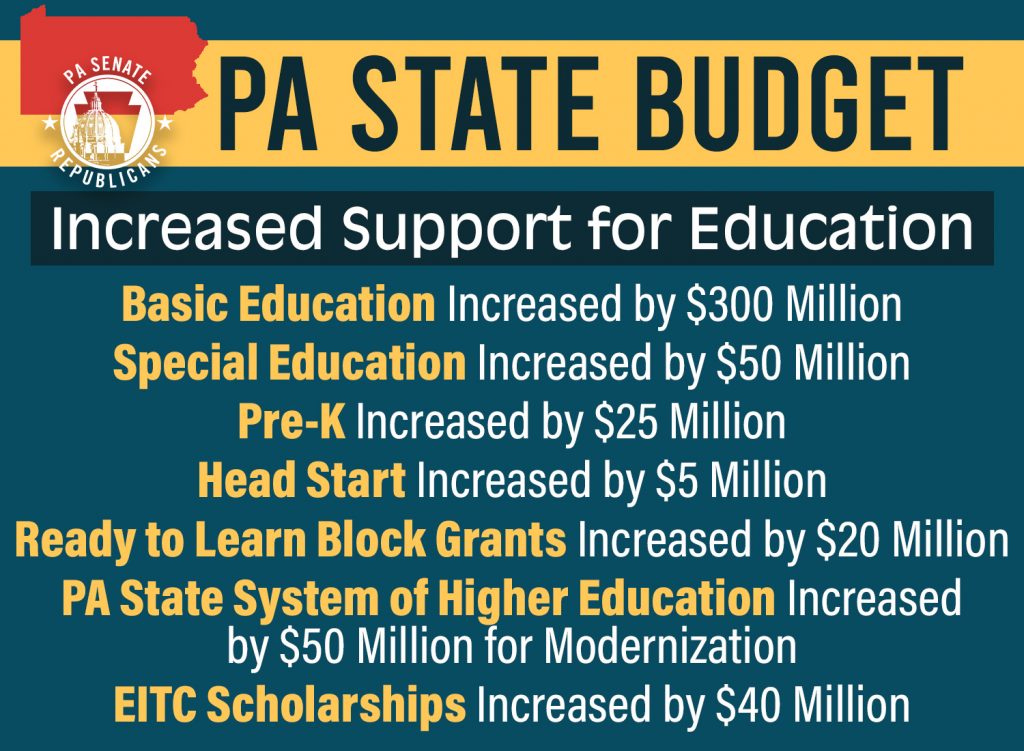

State Budget Pa Senate Gop Issues

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Pa Eitc Tax Credit Explained Central Pennsylvania Scholarship Fund

Adopt A School The Education Partnership

New Pa Budget Injects 125m Into Private School Tax Credit Program That Lacks Basic Accountability Spotlight Pa

Welcome To Kiss Theatre Company Kiss Theatre Company

Hearthsong Sky Island Swing Set Swing Set Outdoor Backyard Swing

La Escuelita Arcoiris Facebook

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Pa Eitc Tax Credit Explained Central Pennsylvania Scholarship Fund

Jewish Scholarship Llc Jewish Education Scholarship

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Education Tax Credits And Deductions For 2021 Taxes Bankrate

Jewish Scholarship Llc Jewish Education Scholarship

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

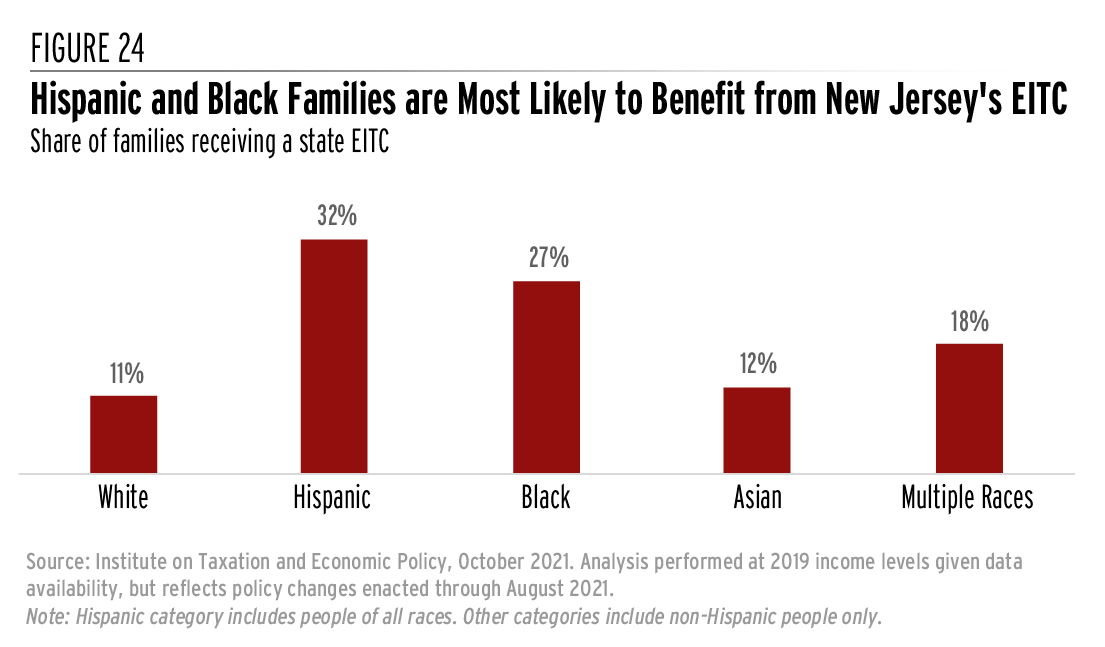

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep